Florida Memory is administered by the Florida Department of State, Division of Library and Information Services, Bureau of Archives and Records Management. The digitized records on Florida Memory come from the collections of the State Archives of Florida and the special collections of the State Library of Florida.

State Archives of Florida

- ArchivesFlorida.com

- State Archives Online Catalog

- ArchivesFlorida.com

- ArchivesFlorida.com

State Library of Florida

Related Sites

Description of previous item

Description of next item

Notice to revenue collectors from the State Comptroller regarding business licenses

Source

State Library of Florida, Florida Collection, BR0031

Description

Searchable collections of manuscripts, war records, historic images, vital statistics, audio and video recordings from the State Library and Archives of Florida.

Date

1873

Format

Topic

Geographic Term

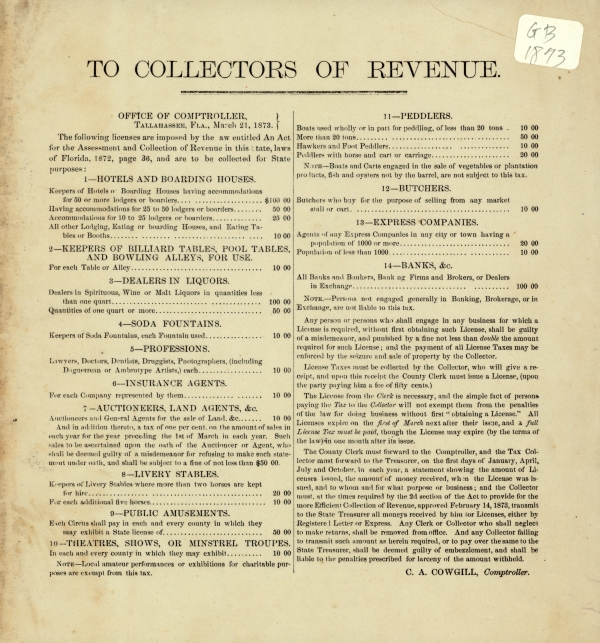

To Collectors of Revenue

[left column]

Office of Comptroller

Tallahassee, Fla., March 21, 1873

The following licenses are imposed by the law entitled An Act

for the Assessment and Collection of Revenue in this state, laws

of Florida, 1872, page 36, and are to be collected for State

purpose:

1-Hotels and Boards House

Keepers of Hotels or Boarding Houses having accommodations

for 50 or more lodgers or boarders $100.00

Having accommodations for 25 to 50 lodgers or boarders 50.00

Accommodations for 10 to 25 lodgers or boarders 25.00

All other Lodging, Eating or boarding Houses, and Eating Tables

or Booths 10.00

2-Keepers of Billiard Tables, Pool Tables,

and Bowling Alleys, for use.

For each Table or Alley 10.00

3-Dealers in Liquors

Dealers in Spirituous, Wine or Malt Liquors in quantities less

than one quart 100.00

Quantities of one quart or more 50.00

4-Soda Fountains

Keepers of Soda Fountains, each Fountain used 10.00

5-Professions.

Lawyers, Doctors, Dentists, Druggists, Photographers (including

Daguerrean or Ambrotype Artists,) each 10.00

6-Insurance Agents

For each Company represented by them 10.00

7-Auctioneers, Land Agents, &c

Auctioneers and General Agents for the sale of Land, &c 10.00

And in addition thereto, a tax of one per cent on amount of sales in

each year for the year preceding the 1st of March in each year. Such

sales to be ascertained upon the oath of the Auctioneer or Agent, who-

shall be deemed guilty of a misdemeanor for refusing to make such statement

under oath, and shall be subject to a fine of not less than $50.00

8-Livery Stables

Keepers of Livery Stables where more than two horses are kept

for hire 20.00

For each additional five horses 10.00

9-Public Amusements

Each Circus shall pay in each and every country in which they

may exhibit a State license of 50.00

10-Theatres, Shows, or Minstrel Troupes

in each and every county in which they may exhibit 10.00

Note-Local amateur performances or exhibitions for charitable purposes

are exempt from this tax.

11-Peddlers.

Boats used wholly or in part for peddling less than 20 tons. 10.00

More than 20 tons 50.00

Hawkers and Foot Peddlers 10.00

Peddlers with horse and cart or carriage 20.00

Note-Boats and Carts engaged in the sale of vegetables or plantation

products, fish and oysters not by the barrel, are not subject to this tax.

12-Butchers

Butchers who buy for the purpose of selling from any market

stall or cart 10.00

13-Express Companies

Agents of any Express Companies in any city or town having a

population of 1000 or more 20.00

Population of less than 1000 10.00

14-Banks, &c.

All Banks and Bankers, Bank ag. Firms and Brokers, or Dealers

in Exchange 100.00

Note.-Persons not engaged generally in Banking, Brokerage, or in

Exchange, are not liable to this tax.

Any person or person who shall engage in any business for which a

License is required, without first obtaining such License, shall be guilty

of a misdemeanor, and punished by a fine not less than double the amount

required for such License; and the payment of all License Taxes may be

enforced by the seizure and sale of property by the Collector.

License Taxes must be collected by the Collector, who will give a receipt,

and upon this receipt the County Clerk must issue a License, (upon

the party paying him a fee of fifty cents.)

The License from the Clerk is necessary, and the simple fact of persons

paying the Tax to the Collector will not exempt them from the penalties

of the law for doing business without first "obtaining a License." All

Licenses expire on the first of March next after their issue, and a full

License Tax must be paid, through the License may expire (by the terms of

the law) in one month after its issue.

The County Clerk must forward to the Comptroller, and the Tax Collector

must forward to the Treasurer, on the first days of January, April,

July and October, in each year, a statement showing the amount of Licensors

issued, the amount of money received when the License was issued,

and to whom and for what purpose or business; and the Collector

must, at the times required by the 2nd section of the Act to provide for the

more Efficient Collection of Revenue, approved February 14, 1873, transmits

to the State Treasurer all money received by him for Licenses, either by

Registere [sic]/ Letter or Express. Any Clerk or Collector who shall neglect

to make returns shall be removed from office. And any Collector failing

to transmit such amount as herein required, or to pay over the same to the

State Treasurer, shall be deemed guilty of embezzlement, and shall be

liable to the penalties prescribed for larceny of the amount withheld.

C.A. Cowgill, Comptroller.

[left column]

Office of Comptroller

Tallahassee, Fla., March 21, 1873

The following licenses are imposed by the law entitled An Act

for the Assessment and Collection of Revenue in this state, laws

of Florida, 1872, page 36, and are to be collected for State

purpose:

1-Hotels and Boards House

Keepers of Hotels or Boarding Houses having accommodations

for 50 or more lodgers or boarders $100.00

Having accommodations for 25 to 50 lodgers or boarders 50.00

Accommodations for 10 to 25 lodgers or boarders 25.00

All other Lodging, Eating or boarding Houses, and Eating Tables

or Booths 10.00

2-Keepers of Billiard Tables, Pool Tables,

and Bowling Alleys, for use.

For each Table or Alley 10.00

3-Dealers in Liquors

Dealers in Spirituous, Wine or Malt Liquors in quantities less

than one quart 100.00

Quantities of one quart or more 50.00

4-Soda Fountains

Keepers of Soda Fountains, each Fountain used 10.00

5-Professions.

Lawyers, Doctors, Dentists, Druggists, Photographers (including

Daguerrean or Ambrotype Artists,) each 10.00

6-Insurance Agents

For each Company represented by them 10.00

7-Auctioneers, Land Agents, &c

Auctioneers and General Agents for the sale of Land, &c 10.00

And in addition thereto, a tax of one per cent on amount of sales in

each year for the year preceding the 1st of March in each year. Such

sales to be ascertained upon the oath of the Auctioneer or Agent, who-

shall be deemed guilty of a misdemeanor for refusing to make such statement

under oath, and shall be subject to a fine of not less than $50.00

8-Livery Stables

Keepers of Livery Stables where more than two horses are kept

for hire 20.00

For each additional five horses 10.00

9-Public Amusements

Each Circus shall pay in each and every country in which they

may exhibit a State license of 50.00

10-Theatres, Shows, or Minstrel Troupes

in each and every county in which they may exhibit 10.00

Note-Local amateur performances or exhibitions for charitable purposes

are exempt from this tax.

11-Peddlers.

Boats used wholly or in part for peddling less than 20 tons. 10.00

More than 20 tons 50.00

Hawkers and Foot Peddlers 10.00

Peddlers with horse and cart or carriage 20.00

Note-Boats and Carts engaged in the sale of vegetables or plantation

products, fish and oysters not by the barrel, are not subject to this tax.

12-Butchers

Butchers who buy for the purpose of selling from any market

stall or cart 10.00

13-Express Companies

Agents of any Express Companies in any city or town having a

population of 1000 or more 20.00

Population of less than 1000 10.00

14-Banks, &c.

All Banks and Bankers, Bank ag. Firms and Brokers, or Dealers

in Exchange 100.00

Note.-Persons not engaged generally in Banking, Brokerage, or in

Exchange, are not liable to this tax.

Any person or person who shall engage in any business for which a

License is required, without first obtaining such License, shall be guilty

of a misdemeanor, and punished by a fine not less than double the amount

required for such License; and the payment of all License Taxes may be

enforced by the seizure and sale of property by the Collector.

License Taxes must be collected by the Collector, who will give a receipt,

and upon this receipt the County Clerk must issue a License, (upon

the party paying him a fee of fifty cents.)

The License from the Clerk is necessary, and the simple fact of persons

paying the Tax to the Collector will not exempt them from the penalties

of the law for doing business without first "obtaining a License." All

Licenses expire on the first of March next after their issue, and a full

License Tax must be paid, through the License may expire (by the terms of

the law) in one month after its issue.

The County Clerk must forward to the Comptroller, and the Tax Collector

must forward to the Treasurer, on the first days of January, April,

July and October, in each year, a statement showing the amount of Licensors

issued, the amount of money received when the License was issued,

and to whom and for what purpose or business; and the Collector

must, at the times required by the 2nd section of the Act to provide for the

more Efficient Collection of Revenue, approved February 14, 1873, transmits

to the State Treasurer all money received by him for Licenses, either by

Registere [sic]/ Letter or Express. Any Clerk or Collector who shall neglect

to make returns shall be removed from office. And any Collector failing

to transmit such amount as herein required, or to pay over the same to the

State Treasurer, shall be deemed guilty of embezzlement, and shall be

liable to the penalties prescribed for larceny of the amount withheld.

C.A. Cowgill, Comptroller.

Title

Notice to revenue collectors from the State Comptroller regarding business licenses

Subject

Business licenses

Taxation

Source

State Library of Florida, Florida Collection, BR0031

Date

1873

Format

memorandums

Language

eng-US

Type

Text

Identifier

flc_br0031

Coverage

Reconstruction Era Florida (1865-1877)

Geographic Term

Florida

Thumbnail

/fmp/selected_documents/thumbnails/flc_br0031.jpg

Display Date

published 1873

ImageID

flc_br0031_01

topic

Politics and Government

Subject - Corporate

State of Florida, Office of the Comptroller

Subject - Person

Cowgill, Clayton A.

Transcript

To Collectors of Revenue

[left column]

Office of Comptroller

Tallahassee, Fla., March 21, 1873

The following licenses are imposed by the law entitled An Act

for the Assessment and Collection of Revenue in this state, laws

of Florida, 1872, page 36, and are to be collected for State

purpose:

1-Hotels and Boards House

Keepers of Hotels or Boarding Houses having accommodations

for 50 or more lodgers or boarders $100.00

Having accommodations for 25 to 50 lodgers or boarders 50.00

Accommodations for 10 to 25 lodgers or boarders 25.00

All other Lodging, Eating or boarding Houses, and Eating Tables

or Booths 10.00

2-Keepers of Billiard Tables, Pool Tables,

and Bowling Alleys, for use.

For each Table or Alley 10.00

3-Dealers in Liquors

Dealers in Spirituous, Wine or Malt Liquors in quantities less

than one quart 100.00

Quantities of one quart or more 50.00

4-Soda Fountains

Keepers of Soda Fountains, each Fountain used 10.00

5-Professions.

Lawyers, Doctors, Dentists, Druggists, Photographers (including

Daguerrean or Ambrotype Artists,) each 10.00

6-Insurance Agents

For each Company represented by them 10.00

7-Auctioneers, Land Agents, &c

Auctioneers and General Agents for the sale of Land, &c 10.00

And in addition thereto, a tax of one per cent on amount of sales in

each year for the year preceding the 1st of March in each year. Such

sales to be ascertained upon the oath of the Auctioneer or Agent, who-

shall be deemed guilty of a misdemeanor for refusing to make such statement

under oath, and shall be subject to a fine of not less than $50.00

8-Livery Stables

Keepers of Livery Stables where more than two horses are kept

for hire 20.00

For each additional five horses 10.00

9-Public Amusements

Each Circus shall pay in each and every country in which they

may exhibit a State license of 50.00

10-Theatres, Shows, or Minstrel Troupes

in each and every county in which they may exhibit 10.00

Note-Local amateur performances or exhibitions for charitable purposes

are exempt from this tax.

11-Peddlers.

Boats used wholly or in part for peddling less than 20 tons. 10.00

More than 20 tons 50.00

Hawkers and Foot Peddlers 10.00

Peddlers with horse and cart or carriage 20.00

Note-Boats and Carts engaged in the sale of vegetables or plantation

products, fish and oysters not by the barrel, are not subject to this tax.

12-Butchers

Butchers who buy for the purpose of selling from any market

stall or cart 10.00

13-Express Companies

Agents of any Express Companies in any city or town having a

population of 1000 or more 20.00

Population of less than 1000 10.00

14-Banks, &c.

All Banks and Bankers, Bank ag. Firms and Brokers, or Dealers

in Exchange 100.00

Note.-Persons not engaged generally in Banking, Brokerage, or in

Exchange, are not liable to this tax.

Any person or person who shall engage in any business for which a

License is required, without first obtaining such License, shall be guilty

of a misdemeanor, and punished by a fine not less than double the amount

required for such License; and the payment of all License Taxes may be

enforced by the seizure and sale of property by the Collector.

License Taxes must be collected by the Collector, who will give a receipt,

and upon this receipt the County Clerk must issue a License, (upon

the party paying him a fee of fifty cents.)

The License from the Clerk is necessary, and the simple fact of persons

paying the Tax to the Collector will not exempt them from the penalties

of the law for doing business without first "obtaining a License." All

Licenses expire on the first of March next after their issue, and a full

License Tax must be paid, through the License may expire (by the terms of

the law) in one month after its issue.

The County Clerk must forward to the Comptroller, and the Tax Collector

must forward to the Treasurer, on the first days of January, April,

July and October, in each year, a statement showing the amount of Licensors

issued, the amount of money received when the License was issued,

and to whom and for what purpose or business; and the Collector

must, at the times required by the 2nd section of the Act to provide for the

more Efficient Collection of Revenue, approved February 14, 1873, transmits

to the State Treasurer all money received by him for Licenses, either by

Registere [sic]/ Letter or Express. Any Clerk or Collector who shall neglect

to make returns shall be removed from office. And any Collector failing

to transmit such amount as herein required, or to pay over the same to the

State Treasurer, shall be deemed guilty of embezzlement, and shall be

liable to the penalties prescribed for larceny of the amount withheld.

C.A. Cowgill, Comptroller.

[left column]

Office of Comptroller

Tallahassee, Fla., March 21, 1873

The following licenses are imposed by the law entitled An Act

for the Assessment and Collection of Revenue in this state, laws

of Florida, 1872, page 36, and are to be collected for State

purpose:

1-Hotels and Boards House

Keepers of Hotels or Boarding Houses having accommodations

for 50 or more lodgers or boarders $100.00

Having accommodations for 25 to 50 lodgers or boarders 50.00

Accommodations for 10 to 25 lodgers or boarders 25.00

All other Lodging, Eating or boarding Houses, and Eating Tables

or Booths 10.00

2-Keepers of Billiard Tables, Pool Tables,

and Bowling Alleys, for use.

For each Table or Alley 10.00

3-Dealers in Liquors

Dealers in Spirituous, Wine or Malt Liquors in quantities less

than one quart 100.00

Quantities of one quart or more 50.00

4-Soda Fountains

Keepers of Soda Fountains, each Fountain used 10.00

5-Professions.

Lawyers, Doctors, Dentists, Druggists, Photographers (including

Daguerrean or Ambrotype Artists,) each 10.00

6-Insurance Agents

For each Company represented by them 10.00

7-Auctioneers, Land Agents, &c

Auctioneers and General Agents for the sale of Land, &c 10.00

And in addition thereto, a tax of one per cent on amount of sales in

each year for the year preceding the 1st of March in each year. Such

sales to be ascertained upon the oath of the Auctioneer or Agent, who-

shall be deemed guilty of a misdemeanor for refusing to make such statement

under oath, and shall be subject to a fine of not less than $50.00

8-Livery Stables

Keepers of Livery Stables where more than two horses are kept

for hire 20.00

For each additional five horses 10.00

9-Public Amusements

Each Circus shall pay in each and every country in which they

may exhibit a State license of 50.00

10-Theatres, Shows, or Minstrel Troupes

in each and every county in which they may exhibit 10.00

Note-Local amateur performances or exhibitions for charitable purposes

are exempt from this tax.

11-Peddlers.

Boats used wholly or in part for peddling less than 20 tons. 10.00

More than 20 tons 50.00

Hawkers and Foot Peddlers 10.00

Peddlers with horse and cart or carriage 20.00

Note-Boats and Carts engaged in the sale of vegetables or plantation

products, fish and oysters not by the barrel, are not subject to this tax.

12-Butchers

Butchers who buy for the purpose of selling from any market

stall or cart 10.00

13-Express Companies

Agents of any Express Companies in any city or town having a

population of 1000 or more 20.00

Population of less than 1000 10.00

14-Banks, &c.

All Banks and Bankers, Bank ag. Firms and Brokers, or Dealers

in Exchange 100.00

Note.-Persons not engaged generally in Banking, Brokerage, or in

Exchange, are not liable to this tax.

Any person or person who shall engage in any business for which a

License is required, without first obtaining such License, shall be guilty

of a misdemeanor, and punished by a fine not less than double the amount

required for such License; and the payment of all License Taxes may be

enforced by the seizure and sale of property by the Collector.

License Taxes must be collected by the Collector, who will give a receipt,

and upon this receipt the County Clerk must issue a License, (upon

the party paying him a fee of fifty cents.)

The License from the Clerk is necessary, and the simple fact of persons

paying the Tax to the Collector will not exempt them from the penalties

of the law for doing business without first "obtaining a License." All

Licenses expire on the first of March next after their issue, and a full

License Tax must be paid, through the License may expire (by the terms of

the law) in one month after its issue.

The County Clerk must forward to the Comptroller, and the Tax Collector

must forward to the Treasurer, on the first days of January, April,

July and October, in each year, a statement showing the amount of Licensors

issued, the amount of money received when the License was issued,

and to whom and for what purpose or business; and the Collector

must, at the times required by the 2nd section of the Act to provide for the

more Efficient Collection of Revenue, approved February 14, 1873, transmits

to the State Treasurer all money received by him for Licenses, either by

Registere [sic]/ Letter or Express. Any Clerk or Collector who shall neglect

to make returns shall be removed from office. And any Collector failing

to transmit such amount as herein required, or to pay over the same to the

State Treasurer, shall be deemed guilty of embezzlement, and shall be

liable to the penalties prescribed for larceny of the amount withheld.

C.A. Cowgill, Comptroller.

Chicago Manual of Style

Notice to revenue collectors from the State Comptroller regarding business licenses. 1873. State Archives of Florida, Florida Memory. <https://www.floridamemory.com/items/show/212295>, accessed 9 March 2026.

MLA

Notice to revenue collectors from the State Comptroller regarding business licenses. 1873. State Archives of Florida, Florida Memory. Accessed 9 Mar. 2026.<https://www.floridamemory.com/items/show/212295>

AP Style Photo Citation

Listen: The Bluegrass & Old-Time Program

Listen: The Bluegrass & Old-Time Program