Florida Memory is administered by the Florida Department of State, Division of Library and Information Services, Bureau of Archives and Records Management. The digitized records on Florida Memory come from the collections of the State Archives of Florida and the special collections of the State Library of Florida.

State Archives of Florida

- ArchivesFlorida.com

- State Archives Online Catalog

- ArchivesFlorida.com

- ArchivesFlorida.com

State Library of Florida

Related Sites

Description of previous item

Description of next item

Source

Description

Date

Publisher

Format

Coverage

Topic

Geographic Term

November 5, 1963

Freeholders who registered especially for this election will vote on the issuance of bonds in an

amount not exceeding $5,000,000 for the purpose of financing part of the cost of a school build-

ing program.

A majority (4176) of these 8351 registered freeholders must vote to constitute a valid election.

A majority of those voting will determine the outcome.

If the bond issue is defeated, at least a full year must pass before another election can be called.

The Need

The rapid growth of Leon County has made demands on the school system which are not being

met by current revenues.

The present annual increase in enrollment is approximately 480 pupils, or about 3/4 of the enroll-

ment in an average-sized elementary school. Despite major pay-as-you-go construction within the

last five years, more pupils are inadequately housed in 1963 than in 1958.

Current sources for funds for school capital outlay are:

1. A possible $170,000 a year as a result of anticipated reassessment in 1964, IF it can be

spared from maintenance.

2. A state grant of $200 for each pupil in average daily attendance in addition to the

total in the preceding year, If the increase in attendance is 5% or more, and If state

funds are matched by county funds. Although the increase has been 5% in some recent

years, the county has not been able to match the $200 grant. The increase was 3% this

year.

A State Survey Committee recommended expenditure of $7,000,000 for capital improvements. The

Leon County Board of Public Instruction is proposing to borrow $5,000,000 for that purpose.

Proceeds of the bond issue would provide for:

1. Construction of new schools.

2. Major alterations of existing schools.

3. Purchase of new school sites.

The Cost

The bond issue, if approved, would be paid off over a period of 20 years by a tax on real and tangi-

ble personal property. The approximate average amount of money needed each year would be $329,-

000, making the total cost about $6,580,000. It would necessitate an estimated tax increase of

about 4 mills at the present assessment level. This is an average over 20 years. The first year,

because of handling charges, etc., the cost would be about 4 mills; it would decrease gradually there-

after to about 3 mills.

The average cost of 4 mills would amount to $4.00 extra tax each year on each $1,000 of non-

exempt taxable property.

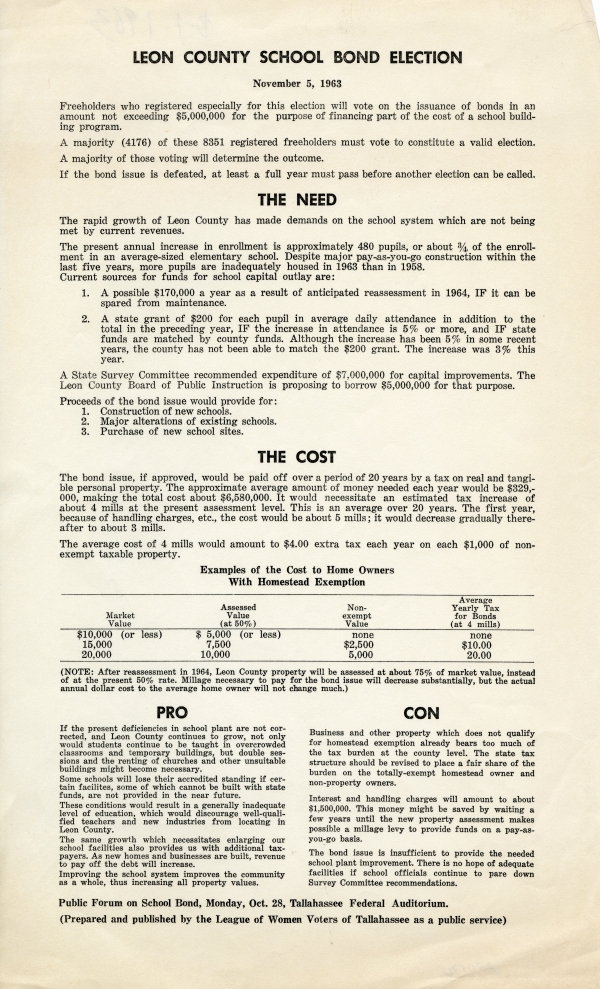

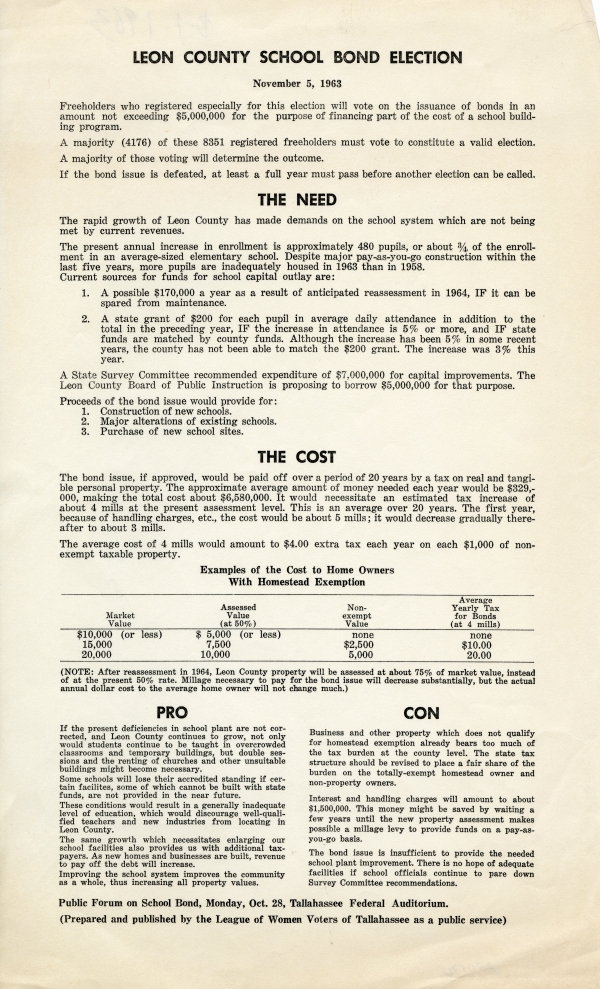

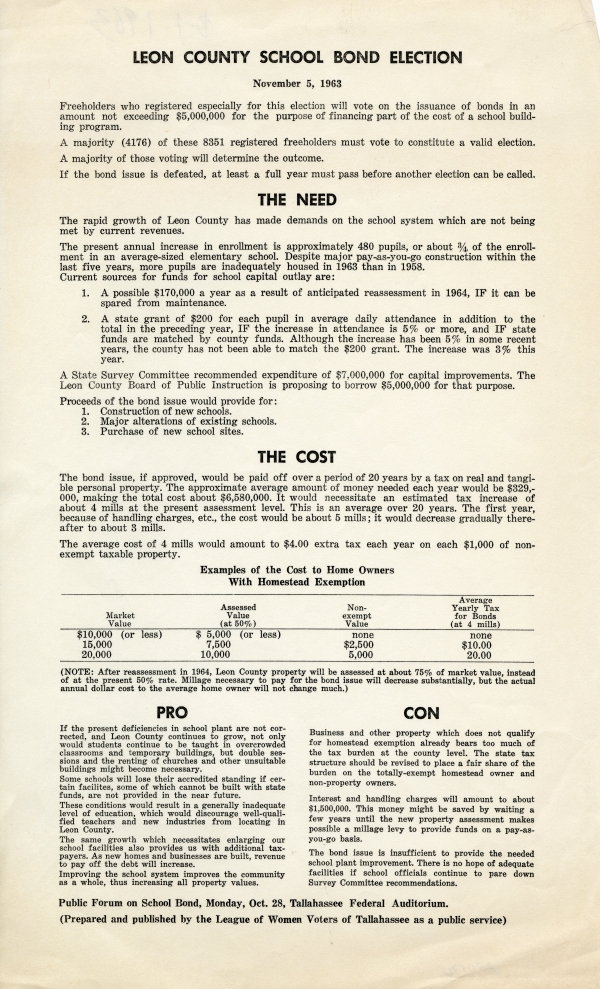

Examples of the Cost to Home Owners

with Homestead Exemption

Market Value Assessed Value (at 50%) Non-exempt Value Average Yearly Tax for Bonds (at 4 mills)

$10,000 (or less) $5,000 (or less) none none

15,000 7,500 $2,500 $10.00

20,000 10,000 5,000 20.00

(NOTE: After reassessment in 1964, Leon County property will be assessed at about 75% of market value, instead

of at the present 50% rate. Millage necessary to pay for the bond issue will decrease substantially, but the actual

annual dollar cost to the aveage home owner will not change much.)

[left column]

PRO

If the present deficiencies in school plant are not cor-

rected, and Leon County continues to grow, not only

would students continue to be taught in overcrowded

classrooms and temporary buildings, but double ses-

sions and the renting of churches and other unsuitable

buildings might become necessary.

Some schools will lose their accredited standing if cer-

tain facililties, some of which cannot be built with state

funds, are not provided in the near future.

These conditions would result in a generally inadequate

level of education, which would discourage well-quali-

fied teachers and new industries from locating in

Leon County.

The same growth which necessitates enlarging our

school facilities also provides us with additional tax-

payers. As new homes and businesses are built, revenue

to pay off the debt will increase.

Improving the school system improves the community

as a whole, thus increasing all property values.

[right column]

CON

Business and other property which does not qualify

for homestead exemption already bears too much of

the tax burden at the county level. The state tax

structure should be revised to place a fair share of the

burdern on the totally-exempt homestead owner and

non-property owners.

Interest and handling charges will amount to about

$1,500,000. This money might be saved by waiting a

few years until the new property assessment makes

possible a millage levy to provide funds on a pay-as-

you-go basis.

The bond issue is insufficient to provide the needed

school plant improvement. There is no hope of adequate

facilities if school officials continue to pare down

Survey Committee recommendations.

Public Forum on School Bond, Monday, Oct. 28, Tallahassee Federal Auditorium.

(Prepared and published by the League of Women Voters of Tallahassee as a public service)

Title

Subject

Description

Creator

Source

Publisher

Date

Format

Language

Type

Identifier

Coverage

Geographic Term

Thumbnail

Display Date

ImageID

topic

Subject - Corporate

Transcript

November 5, 1963

Freeholders who registered especially for this election will vote on the issuance of bonds in an

amount not exceeding $5,000,000 for the purpose of financing part of the cost of a school build-

ing program.

A majority (4176) of these 8351 registered freeholders must vote to constitute a valid election.

A majority of those voting will determine the outcome.

If the bond issue is defeated, at least a full year must pass before another election can be called.

The Need

The rapid growth of Leon County has made demands on the school system which are not being

met by current revenues.

The present annual increase in enrollment is approximately 480 pupils, or about 3/4 of the enroll-

ment in an average-sized elementary school. Despite major pay-as-you-go construction within the

last five years, more pupils are inadequately housed in 1963 than in 1958.

Current sources for funds for school capital outlay are:

1. A possible $170,000 a year as a result of anticipated reassessment in 1964, IF it can be

spared from maintenance.

2. A state grant of $200 for each pupil in average daily attendance in addition to the

total in the preceding year, If the increase in attendance is 5% or more, and If state

funds are matched by county funds. Although the increase has been 5% in some recent

years, the county has not been able to match the $200 grant. The increase was 3% this

year.

A State Survey Committee recommended expenditure of $7,000,000 for capital improvements. The

Leon County Board of Public Instruction is proposing to borrow $5,000,000 for that purpose.

Proceeds of the bond issue would provide for:

1. Construction of new schools.

2. Major alterations of existing schools.

3. Purchase of new school sites.

The Cost

The bond issue, if approved, would be paid off over a period of 20 years by a tax on real and tangi-

ble personal property. The approximate average amount of money needed each year would be $329,-

000, making the total cost about $6,580,000. It would necessitate an estimated tax increase of

about 4 mills at the present assessment level. This is an average over 20 years. The first year,

because of handling charges, etc., the cost would be about 4 mills; it would decrease gradually there-

after to about 3 mills.

The average cost of 4 mills would amount to $4.00 extra tax each year on each $1,000 of non-

exempt taxable property.

Examples of the Cost to Home Owners

with Homestead Exemption

Market Value Assessed Value (at 50%) Non-exempt Value Average Yearly Tax for Bonds (at 4 mills)

$10,000 (or less) $5,000 (or less) none none

15,000 7,500 $2,500 $10.00

20,000 10,000 5,000 20.00

(NOTE: After reassessment in 1964, Leon County property will be assessed at about 75% of market value, instead

of at the present 50% rate. Millage necessary to pay for the bond issue will decrease substantially, but the actual

annual dollar cost to the aveage home owner will not change much.)

[left column]

PRO

If the present deficiencies in school plant are not cor-

rected, and Leon County continues to grow, not only

would students continue to be taught in overcrowded

classrooms and temporary buildings, but double ses-

sions and the renting of churches and other unsuitable

buildings might become necessary.

Some schools will lose their accredited standing if cer-

tain facililties, some of which cannot be built with state

funds, are not provided in the near future.

These conditions would result in a generally inadequate

level of education, which would discourage well-quali-

fied teachers and new industries from locating in

Leon County.

The same growth which necessitates enlarging our

school facilities also provides us with additional tax-

payers. As new homes and businesses are built, revenue

to pay off the debt will increase.

Improving the school system improves the community

as a whole, thus increasing all property values.

[right column]

CON

Business and other property which does not qualify

for homestead exemption already bears too much of

the tax burden at the county level. The state tax

structure should be revised to place a fair share of the

burdern on the totally-exempt homestead owner and

non-property owners.

Interest and handling charges will amount to about

$1,500,000. This money might be saved by waiting a

few years until the new property assessment makes

possible a millage levy to provide funds on a pay-as-

you-go basis.

The bond issue is insufficient to provide the needed

school plant improvement. There is no hope of adequate

facilities if school officials continue to pare down

Survey Committee recommendations.

Public Forum on School Bond, Monday, Oct. 28, Tallahassee Federal Auditorium.

(Prepared and published by the League of Women Voters of Tallahassee as a public service)

Chicago Manual of Style

League of Women Voters of Tallahassee. Leon County School Bond Election, 1963. 1963. State Archives of Florida, Florida Memory. <https://www.floridamemory.com/items/show/212308>, accessed 13 February 2026.

MLA

League of Women Voters of Tallahassee. Leon County School Bond Election, 1963. 1963. State Archives of Florida, Florida Memory. Accessed 13 Feb. 2026.<https://www.floridamemory.com/items/show/212308>

AP Style Photo Citation

(State Archives of Florida/League of Women Voters of Tallahassee)

Listen: The Bluegrass & Old-Time Program

Listen: The Bluegrass & Old-Time Program