Description of previous item

Description of next item

Florida's Union Bank

Published September 9, 2014 by Florida Memory

Florida’s habit of booming and busting stretches far back, much farther than the land boom of the 1920s many Floridians already know about. One of the most controversial busts happened shortly after Florida became a U.S. territory.

Like most frontier societies with a future, Florida was full of eager settlers with a vision. And visions require money. In the agricultural economy of the Old South, much of the wealth was tied up in land, slaves, and the capital goods necessary to grow crops. Even the wealthiest planters relied heavily on credit to do business, because there just wasn’t much cash to be had. So what do you do when you need better access to cash and credit? You build a bank, of course!

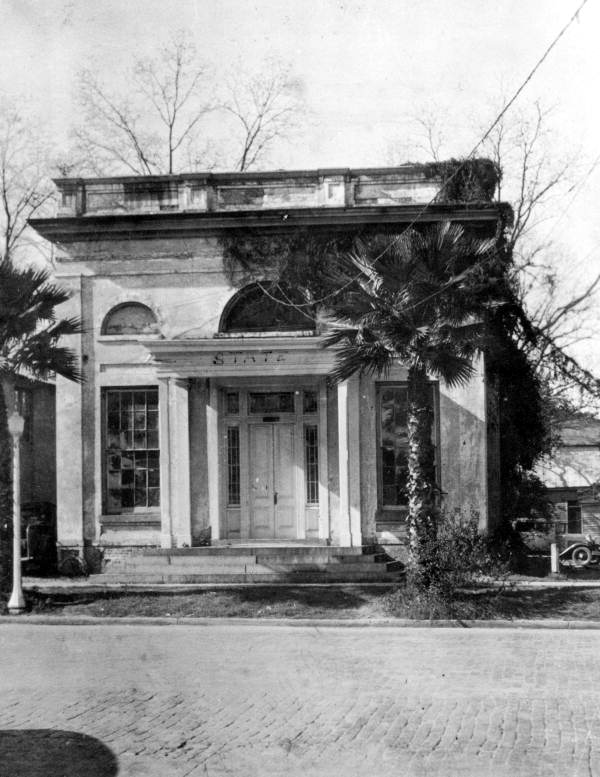

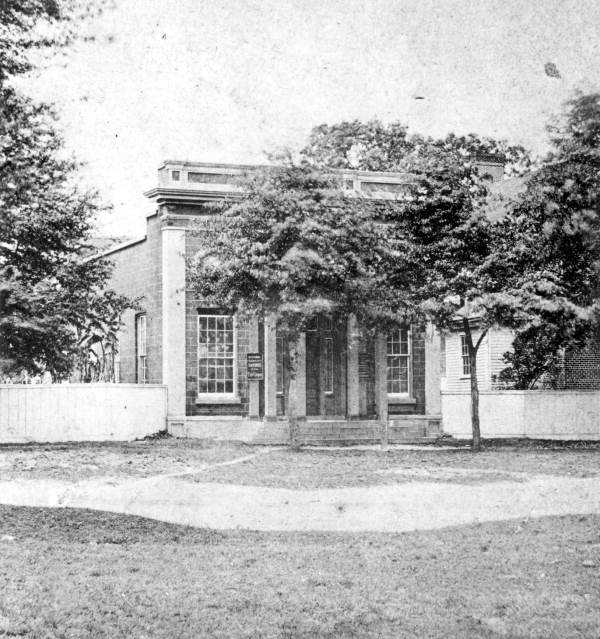

This building served the Union Bank of Florida, two of its predecessor banks, and a freedmen’s savings bank opened after the Civil War (Tallahassee, circa 1870s).

The Spanish had barely weighed anchor and left Pensacola before efforts began to get a bank established in Florida. Military Governor Andrew Jackson forwarded a petition of Pensacola citizens to the federal government asking for a branch of the United States Bank. Their request was denied. A number of Floridians also attempted to have the territorial government charter a bank, but Governor William Pope Duval vetoed every proposal, believing banks to be monopolistic.

William Pope Duval, Florida’s first territorial governor (in office 1822-1834). Date of painting unknown.

After the U.S. weathered its banking crisis and the United States Bank was no more, credit and cash-hungry planters renewed their demand for some kind of bank in Florida. In 1828, enough support developed in the territorial legislature to pass a charter for the Bank of Florida at Tallahassee. Lawmakers would charter a total of 18 banks between 1828 and 1839, but the most interesting (and most infamous) of these was the Union Bank of Florida, also established at Tallahassee.

The Union Bank, chartered in 1833, was founded by a group of planters led by John Grattan Gamble of Jefferson County. Gamble and his associates believed if they could only get enough capital to bring their land under full cultivation, they could quickly make a tremendous amount of money. The first problem, however, was to get enough capital to start the bank.

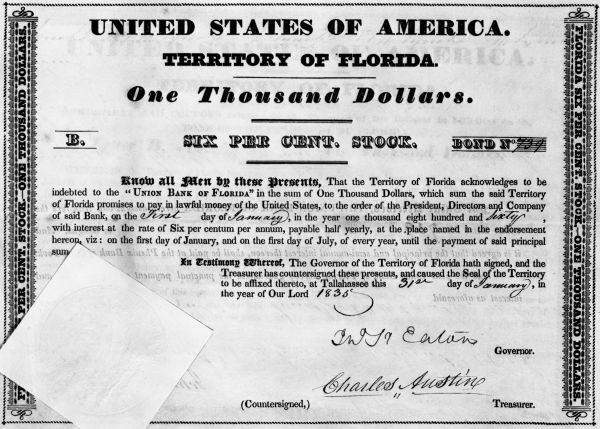

Gamble and his associates used a common scheme of that era to finance the new bank. First, the planters purchased stock in the new institution by mortgaging their land and slaves, the most valuable assets they owned. Operating cash came from the sale of thousand-dollar bonds guaranteed by the territorial government, redeemable in 1860 with six percent interest. Gamble intended to go abroad and drum up more capital from foreign investors. Surely they would recognize the potential of an untapped agricultural paradise like Florida. What could possibly go wrong?

A $1,000 bond of the territorial government of Florida, designed to capitalize the Union Bank (1835).

A lot could go wrong, and a lot did go wrong at the Union Bank. The bank’s officials were the ones who determined how much a stockholder’s land was worth, and therefore how much stock he might receive in return for mortgaging it, and how much money he might borrow from the bank. This almost immediately led to charges of favoritism. Some of Gamble’s friends and family received larger amounts of bank stock and credit than other planters with the same amount of collateral. Lots of folks had paid into the scheme to get the bank started, but only a few were receiving any benefit.

Moreover, the Panic of 1837 and a severe drought in 1840 combined to tax the bank’s resources to the maximum. The law prohibited the bank from increasing its capital through more bond sales, which left the bank unable to pay its debts to its stockholders or on the territorial bonds that had originally funded its creation. The territorial government was left holding the bag for these latter obligations. When it became clear in 1843 that the Union Bank would not recover, the legislature suspended its banking authority by law.

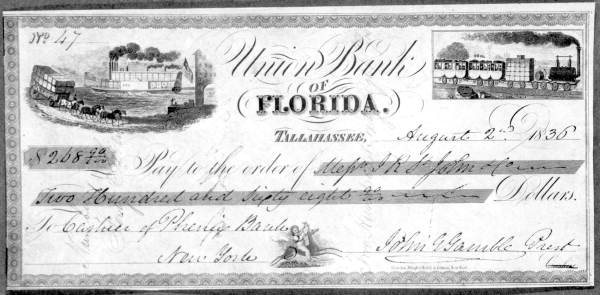

A check from Union Bank president John Grattan Gamble to the Phenix Bank of New York, dated August 2, 1836. Not long after this, the bank’s credit would drastically drop and its checks and currency would be widely rejected.

The Union Bank may have passed away, but the building lived on to serve many useful purposes in Tallahassee. From the end of the Civil War until 1879 it served as a savings bank for freedmen. At other times it served as a feed store, shoe factory, coffee house, art gallery, locksmith’s shop, and even a church.

By the mid 20th century, however, the building was showing signs of neglect. Local historians and preservationists succeeded in having the building recognized as a historic landmark in 1967. The building’s location on prime Tallahassee real estate, however, threatened its continued existence. To save the building from being demolished for a parking lot, a group of local citizens and the state government teamed up to raise $40,000 to have the Union Bank building moved to its present location on Apalachee Parkway. It now houses Florida A&M University’s Black Archives Research Center.

What are the oldest buildings in your Florida community? Search for photos of these and other historic Florida structures in the Florida Photographic Collection.

Cite This Article

Chicago Manual of Style

(17th Edition)Florida Memory. "Florida's Union Bank." Floridiana, 2014. https://www.floridamemory.com/items/show/295221.

MLA

(9th Edition)Florida Memory. "Florida's Union Bank." Floridiana, 2014, https://www.floridamemory.com/items/show/295221. Accessed March 9, 2026.

APA

(7th Edition)Florida Memory. (2014, September 9). Florida's Union Bank. Floridiana. Retrieved from https://www.floridamemory.com/items/show/295221

Listen: The Folk Program

Listen: The Folk Program