The Cigar Industry Changes Florida

Documents and Media

First National Bank of Tampa

From: First Florida Banks, Inc. (Tampa, Fla.), Records, 1874-1992, Collection M99- 5

Under the Bank of Tampa's leadership, the Tampa Board of Trade donated funds in 1886 for Vicente Ybor to relocate his cigar industry from Key West to Tampa. The bank continued to be closely tied to the cigar making industry.

Cashier’s Report, July 2, 1904

TRANSCRIPT OF CASHIER'S REPORT FOR FIRST NATIONAL BANK OF TAMPA, JULY 2, 1904

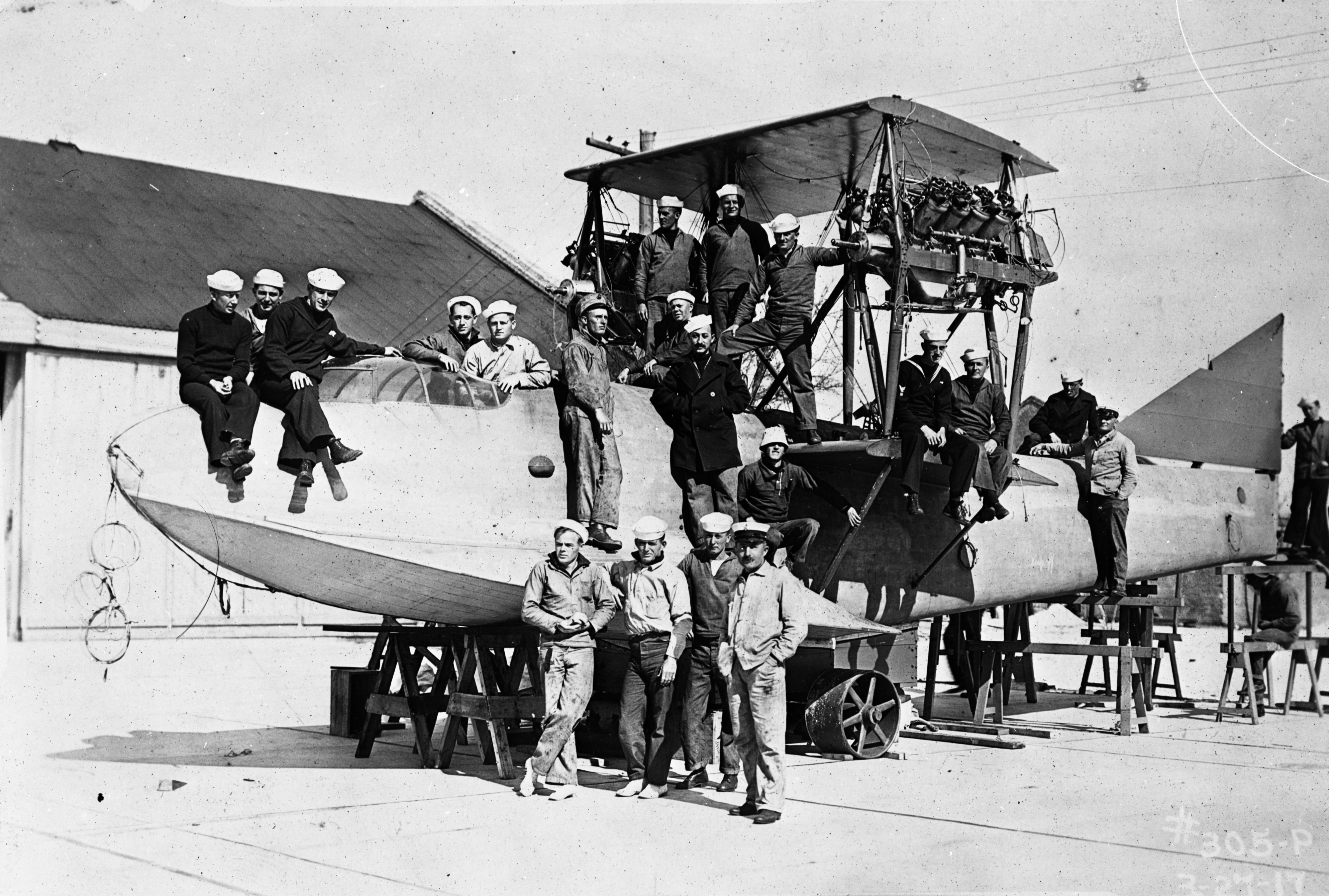

[image 1]

To the Honorable Board of Directors

First National Bank of Tampa

Gentlemen:

I beg to submit the following report of earnings and expenses of this bank for the six months ending June 30th, 1904.

Earnings

From Interest $47,749.77

From Exchange 5,222.38

From Rent 734.65

$53,706.80

Expenses

Amount Expense Account $20,125.68

Profit and Loss 4,408.75, 24,534.43

Net earnings $29,172.37

The item of "Profit and Loss" is composed of two entrys, to wit:

Owing to depreciation in the value of United States Bonds, on February 23rd, last, we credit the account of "Premium on Bonds" with $4,408.75 and charged that sum to the account of "Profit and Loss" This leaves our two per cent bonds standing on our books at one hundred and four and the four percent bonds standing at one hundred and six. On June 16th, 1904

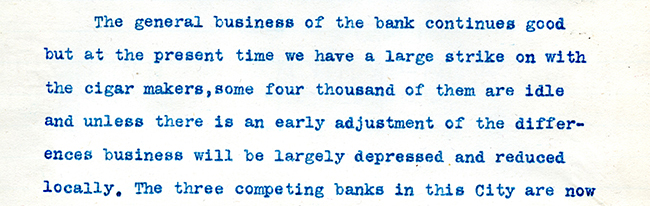

[image 2]

we charge to the account of "Profit and Loss" $360.00 account of a balance due from the failed business of Messrs Sharp Smith and Co, stationers of this City.

There is nothing new of interest to report. We have a claim of four thousand dollars against the Estate of B.E. Coe, with some securety, and it looks at the moment as if we may sustain some loss from same but it is impossible to say what will be the outcome.

The general business of the bank continues good but at the present time we have a large strike on with the cigar makers, some four thousand of them are idle and unless there is an early adjustment of the differences business will be largely depressed and reduced locally. The three competing banks in this City are now offering interest on deposits and it seems to me that it would be wise, where the Management finds it necessary, for us to issue certificates of deposit to customers who desire to leave funds on deposit for say three or more months, said certificates to carry interest say at the rate of two to three per cent. Unless we meet competition we can not of-course expect to hold all of our customers who have idle funds and desire some returns on same.

Respectfully submitted

D.F. Conoley, Cashier

Listen: The Folk Program

Listen: The Folk Program